EMV Compliancy Mandate

The dealine for EMV Compliance is October 1st 2015

Until Fraud Liability Shift

POS Mobile Integration

New Mobile API software to integrate the industry leading mobile devices with your Micros or Agylisis POS system. The industries first integration to allow you to operate business as usual. Open your transactions on your existing POS system and close them out on your new mobile devices. All transactional information will be seamlessly delivered back to your POS system for full reconciliation.

P2PE Gateway

Data sheets available for download.

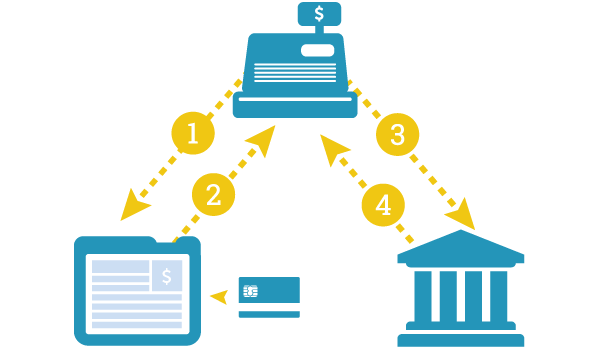

Current Model

- Transaction data flows from the POS to the terminal.

- Payment data flows from the terminal to the POS.

- Payment data flows from the aquirer or gateway.

- Non-Payment data then flows back to the POS.

New Secure Commerce Architecture Model

- Transaction data flows from the POS to the terminal.

- Payment data flows from the terminal to the POS.

- Payment data flows from the aquirer or gateway.

- Non-Payment data then flows back to the POS.

What is the Right Architecture for You

A very crowded and Complex Payment Processing Ecosystem

Full Integration of an EMV & PCI Compliant Architecture

EMV Compliant Architecture

Our IT Security team will work through this entire payment architecture to find the right EMV and PCI compliant architecture that fits your environment.

Industry Breach Information

Adoption of EMV

Through the adoption of EMV, your company securely removes cardholder data from an unguarded environment while removing your liability within the transaction. Through the adoption of EMV in Europe and Canada fraud associated to stolen credit cards and breached information was reduced by more than 70% within the first 3 years. With a fully compliant EMV architecture your business will significantly reduce the complexity of your PCI compliance audits and the cost associated to them.Your Organizations Risk

Data Breach Costs continue to rise in America. In 2014 payment fraud surpassed $11 billion. Records are being compromised at a staggering rate with massive breaches taking place in the government and commercial space. The average cost of a breach increased from $188 to $201 per credit card account this year. Small to medium businesses with 10,000 accounts could suffer fines of over $2M from the acquiring banks. These type of pervasive breaches have crippled even the strongest businesses.The small and mid-market companies will continue to be the top targets for fraud due to the current statistics associated to these companies having less money to spend on better security and more resources to put better policies and procedures in place to help mitigate breaches.